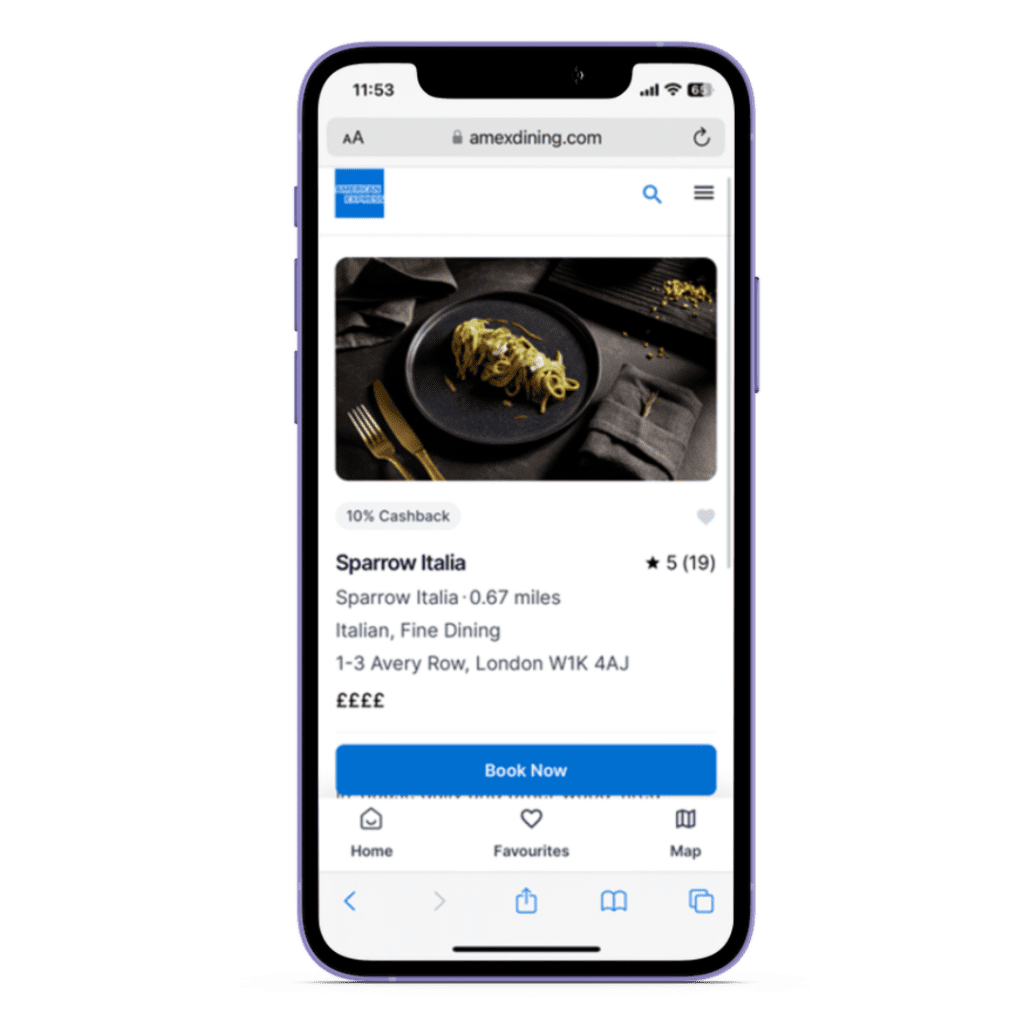

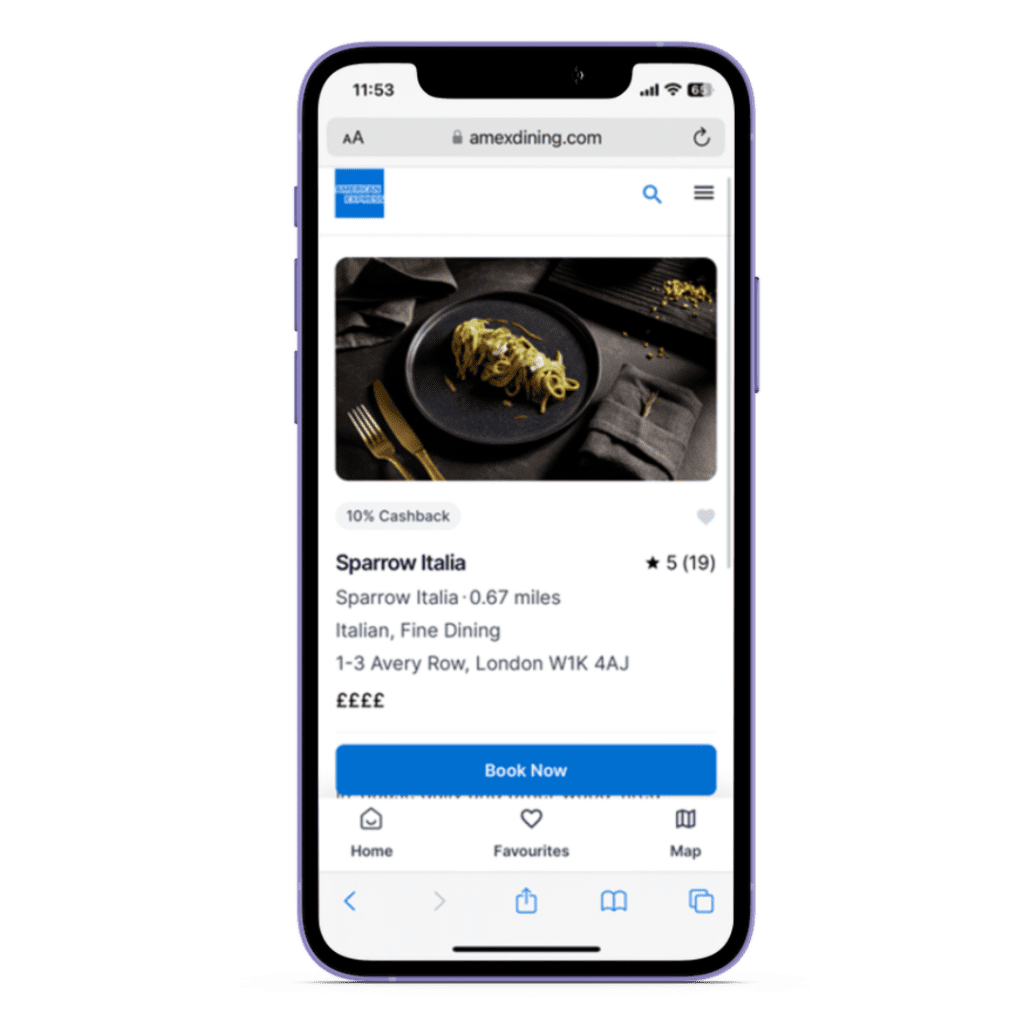

Krowd supports hospitality brands with acquisitions for new and lapsed customers by promoting them to 26m+ UK customers through partnerships with banks, airlines, telcos and more. Krowd’s publishing partners include American Express, Airtime Rewards (EE & O2 Rewards), British Airways Executive Club, Zilch, Curve and MasterCard B2B. They work closely with brands to choose the most suited publishing partners, ensuring the best ROI on reaching their target audiences, without compromising on brand image.

Hospitality brands can gain access to an extensive audience of over 26 million UK bank card holders. This approach amplifies brand visibility and enables them to attract new customers and re-engage with old ones. This strategy has a track record of increasing profitability for restaurants, by driving more transactions and more revenue. In addition, it requires no integration with other platforms and no additional training for in venue teams.

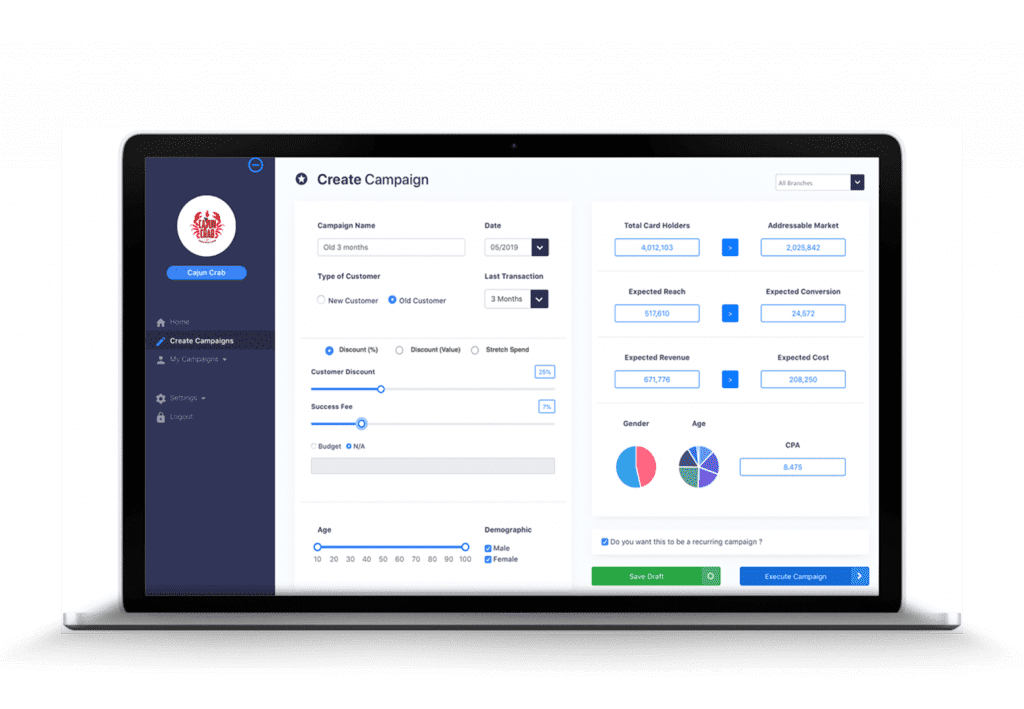

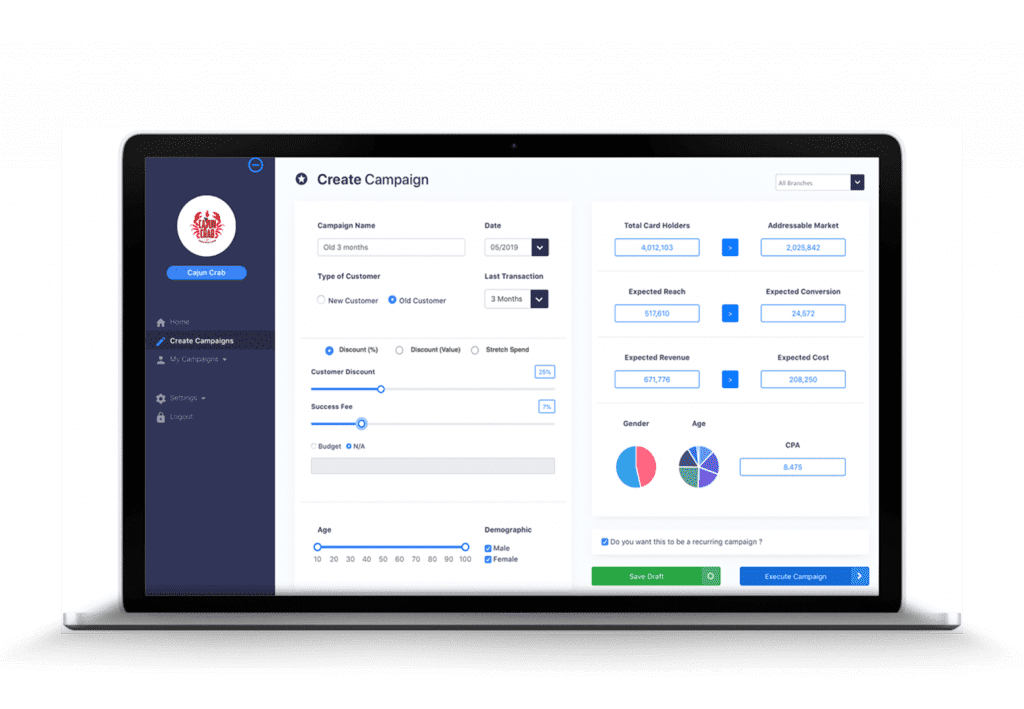

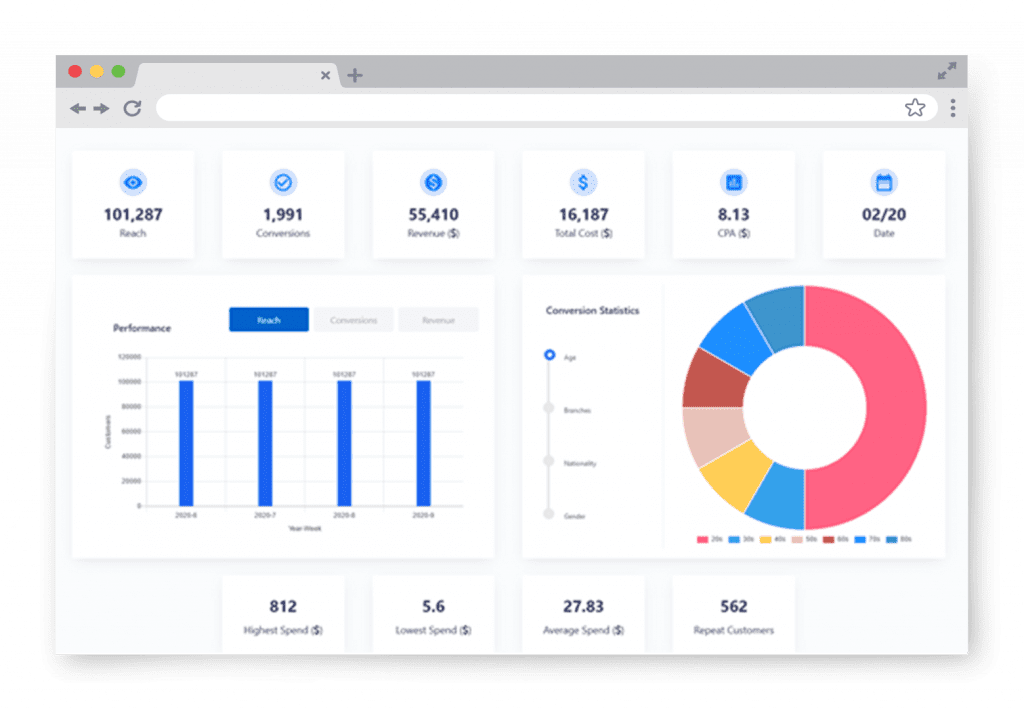

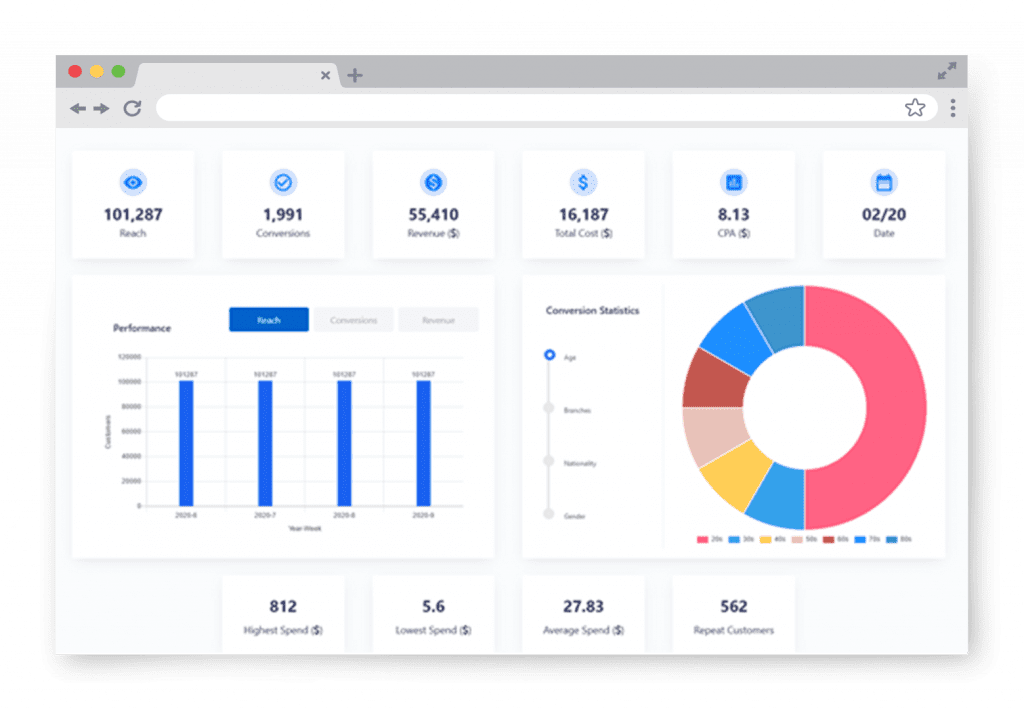

Through data-driven insights and efficient marketing, Krowd’s platform enables informed decision-making, personalised experiences, and upselling opportunities. Partnering hospitality brands have benefitted from boosted revenue, enhanced customer loyalty, and increased Average Transaction Value (ATV). Notably, there are no upfront costs or concealed fees – you only pay for customers who spend because of the campaigns.

This year, more than 150+ brands, across 1700 locations, actively engaged in dining offers facilitated by Krowd’s publishing network. This has enabled brands to achieve results including:

By delving into the preferences of a brand’s core audience via the analysis of customer data and behaviour, Krowd can identify distinct segments. These segments pave the way for tailored promotional offers and incentives that resonate with customers. Through strategic partnerships, as well as personalised communication and data-driven insights, Krowd enables brands to attract and retain customers, drive engagement, and foster ongoing brand loyalty.

Since 2002 TISSL have been helping real people and real businesses with their technology needs allowing them to provide the best possible customer experience.

Fill out the form to get in touch with a member of our team and find out how we can help you.